After gyrations in February, air freight rates end the month lower

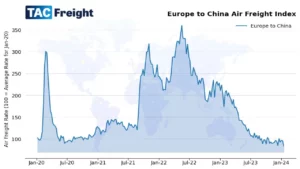

February was a strange month in air cargo markets, with a range of conflicting factors driving market rates wildly up and down at different points over the period. Among the key factors were notably the continuing disruption to ocean shipping traffic in the Red Sea – and the big surge in shipping rates that had sparked late last year. There were also instances of congestion leading to the suspension of air cargo business for short periods in certain locations, notably in Dubai and then in Bangkok – though these did not seem to be related directly to events in the Red Sea. Plus the usual rush of business ahead of the Chinese New Year holiday – which often leads to an observable ‘mini-peak’ in air freight rates in the two to three weeks ahead of that. There was indeed a rise in rates in the period ahead of Chinese New Year, but when the holiday arrived there was also then the usual big fall in volumes – and rates – out of China. After various ups and downs the overall Baltic Air Freight Index (BAI00) ended the four weeks to 4 March lower by -8.7%, leaving it at -25.0% over 12 months, reflecting a market that despite growth in some areas such as e-commerce, remains relatively soft overall. After a rebound in rates in the final week of the month, the index of outbound routes from Hong Kong (BAI30) – still the busiest airport in the world for air cargo – was lower by some -12.0% MoM, leaving it at -13.9% YoY. Despite a similar rebound following Chinese New Year, outbound Shanghai (BAI80) was also lower by -15.1% MoM leaving it at -9.9% over 12 months. Elsewhere out of Asia, however, there were some pretty big moves on other lanes – notably out of India. Rates from India started to surge in mid-February both to Europe and to North America and have kept going up – suggesting that more shippers from there are indeed turning to air cargo to beat the problems with ocean transport in the Red Sea. In other regions, however, the market was quieter. From Europe, the index of outbound routes from Frankfurt (BAI20) edged up by +1.8% MoM, though leaving it still a long way lower YoY at -45.5% reflecting what has continued to be a sluggish economy in Europe. Outbound London Heathrow (BAI40) was also close to flat at -3.0% MoM, leaving it at -48.3% YoY. From the Americas, outbound Chicago (BAI50) was an exception – higher by +9.8% MoM, though still lower by some -35.0% YoY. Debate about the global macro outlook continued to focus heavily on interest rates and prospects for rate cuts – starting in the US and then Europe – and how that might stimulate a revival in economic growth. Markets appeared to be gearing up for rate cuts ahead – despite guidance from Federal Reserve chairman Jerome Powell and other central bank governors that they plan to proceed with caution. And despite the ongoing geopolitical crises in Ukraine and the Middle East, energy price levels – including for jet fuel – remained subdued. Indeed, crude oil prices were flat to down over the month, and the ‘crack spread’ between crude and jet fuel prices also tightened by some 16.8% in the month to 1 March according to Platt’s data, making jet fuel considerably cheaper for carriers. Equity market activity continued to be dominated by the top few US tech stocks, but with some now citing a ‘Magnificent 5’ of Amazon, Alphabet / Google, Meta, Microsoft and Nvidia – no longer a ‘Magnificent 7’ – with Apple and Tesla falling back, partly as they seem to have fewer short to medium term opportunities in artificial intelligence (AI). In Tesla’s case, some investors have argued for a long time that it was hugely overvalued – given continued consumer preferences for hybrid cars rather than electric vehicles (EVs). That has turned out to be more good news so far this year for markets in Japan – given that Toyota is the market leader in hybrids followed by Honda and Hyundai of South Korea. All those stocks have enjoyed a surge since the start of 2024, with the Nikkei 225 index storming ahead by close to 20%. In China, by contrast, the market has struggled – with investors still underwhelmed by official efforts to stimulate stronger economic growth and address problems with the housing sector and youth unemployment. That said, China continues to be by some distance the most important exporter in world markets – including in fast growing sectors like e-commerce. In Europe, too, markets remained somewhat in the doldrums – with the war in Ukraine and higher gas and power prices continuing to cast a shadow. That said, there are some bright spots in Europe too – including stocks like Novo Nordisk in Denmark, which has got investors very excited with its GLP-1 weight loss drugs which appear to offer a highly effective treatment to the global problem with obesity. They seem to be very much the sort of high value products that can and will be transported by air cargo. Another notable development over the month was a surge in cryptocurrencies led by Bitcoin and Ethereum amid renewed optimism about the potential applications and use cases for blockchain technology – something else that would seem to have potential in air cargo markets.