Rates drift in the summer doldrums – but is a bounce coming?

E-commerce activity is still strong, though markets worry about a slowdown in China as well as in the West

E-commerce activity is still strong, though markets worry about a slowdown in China as well as in the West

After a long, steep fall in rates and now a summer lull, hopes are rising for some sort of modest peak season in air freight – one that won’t be either too hot or too cold for markets, but just right

The pace of decline in rates slowed in June, but are we near the bottom yet? Or is that wishful thinking?

Supply chains changing, e-commerce set for further growth, but SAF far from the complete solution on sustainability

But if China keeps growing fast and any recession in the West is brief and shallow, perhaps the market may yet reach a bottom soon

The collapse of Silicon Valley Bank and last-ditch rescue of Credit Suisse have raised the spectre of a renewed financial crisis. But this time does look a bit different.

Lower energy prices and cargo rates may lead to a soft landing for the world economy – and a quicker rebound

The global economy has been stalling – and air freight prices falling. After a big surge during Covid, is the market dropping back as far as pre-pandemic levels?

Shippers and carriers are looking increasingly towards index-linked agreements (ILAs) to manage price volatility.

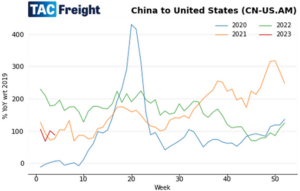

Following a massive surge during the Covid-19 pandemic years, air freight prices have been trending a long way back down over recent months. According to the latest data from TAC Index, the leading price reporting agency (PRA) for air freight, the overall Baltic Air Freight Index (BAI00) is now down a massive -41.3% in the 12 months to 28 November – though still remains, so far, comfortably above pre-pandemic levels. During the past year, there have been some notable regional variations – with routes from China more hard hit than from other major locations, with the index for Outbound Shanghai routes (BAI80) down more steeply by -52.5% YoY. In parts of Southeast Asia, the drops have been more extreme with Vietnam to US and Vietnam to Europe routes, which are dominated more by spot market activity than bigger markets like Shanghai and Hong Kong, both down more than -70% YoY according to the latest TAC data. Over the same period, prices have held up more strongly out of Europe, with the Outbound Frankfurt index (BAI20) only down by -26.4% YoY. And out of North America, the Outbound Chicago index (BAI50) is only down -27.1% YoY. Over the same period, US to Europe routes are only down -7.6%. And US to South America routes are also less negatively affected, with Miami to South America only down -8.7% YoY. So there has been plenty of regional variation. But the overall narrative has been pretty consistent – and consistently bad given negative factors like: These developments have also come at a time when more air freight capacity has been coming back on stream following the pandemic – making more planes available to move less goods. And following a general move by shippers away from ‘just in time’ and towards ‘just in case’ supply chain systems – which has meant inventories high and warehouses full – at a time economic activity has been stalling. All of which leading of course to lower rates for air freight. But, despite the negativity, could all that be about to change? Could the tide turn – and we suddenly reach an inflection point? Over the past month or so, there have been some signs such a change of direction may be coming. First of all, there has been a collapse in European gas prices – arriving like manna from heaven for governments in Europe and the UK, who had been forced into massive support packages to shelter households and businesses from soaring gas and electricity prices. Big support packages for the winter of 2022-23 are already in place. But this recent drop in gas prices should much reduce the level of support required for the following period. That in turn seems to have eased the most gloomy scenarios of a major recession in Europe – boosted by a feeling that Ukraine has now gained the upper hand over Russia, which may help end the war there more swiftly. Second, expectations of rising inflation in the US – which had been causing alarm for markets all around the world – appear to be approaching a peak. With the latest US inflation figures coming in below expectations, markets now expect Federal Reserve chairman Jerome Powell to have more leeway not to push interest rates so high – and hence not squeeze so much growth out of the global economy. Third, and perhaps most importantly, have been expectations that a full reopening of China – post-Covid – must finally happen, and perhaps soon. All of this has been reflected in a sudden surge in global equity prices over the past couple of months, with the MSCI World up more than 6% in November as we approached month-end – and more than 10% in European markets, buoyed by that falling gas price. Taken together, these developments have raised expectations that although the global economy may still be heading for recession, it could be with more of a ‘soft landing’ – which might also mean the ongoing fall in air freight prices coming to an end. Against that, it must be said that plenty of economists and macro commentators remain sceptical that a soft landing can indeed be achieved. Some of these sceptics view the recent equity market rise as something of a ‘dead cat bounce’ – the kind of short term relief rally that often occurs in a bear market. They point to various things – not least that the Ukraine conflict remains far from over, ongoing trade tensions between the US and China, and what they see as a disappointing outcome at the recent Chinese Party Congress – all as factors of concern. The more recent outbreak of nationwide protests across China against continuing Covid restrictions – and market reaction in Asia – will not have eased such concerns. With supply chains in China far from back to normal, there is clearly still plenty to beconcerned about. But it could be that an inflection point is coming. Even if so, an end to the long running fall in air freight prices may take a while to show through – perhaps not until next March or April at the soonest. Any sign of it before then would indeed be an early indicator.